net investment income tax repeal 2021

April 28 2021 The 38 Net Investment Income Tax. September 13 2021.

Financial Planning Now In Anticipation Of The Upcoming Election Aaa Cpa

These individuals are also exempt from the 38 Medicare or net investment income tax NIIT which currently applies only to certain passive income and gains.

. 3 Surtax 5 Not. You can compute your. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to.

Lets look at two examples. Expansion of Net Investment Income Tax 4 Not applicable. If the Supreme Court were to repeal Obamacare in part or whole it is possible that 38 tax on Net Investment Income and the 09 Additional Medicare tax under.

Tax years after December 31 2021. B the excess if any of. The plaintiffs argued that this change was fatal to the entire Affordable Care Act which would include the net investment income tax under IRC 1411 as the Supreme.

How the Obamacare Medicare Tax Works. Your modified adjusted gross income MAGI determines if you owe the net investment income tax. January 5 2017.

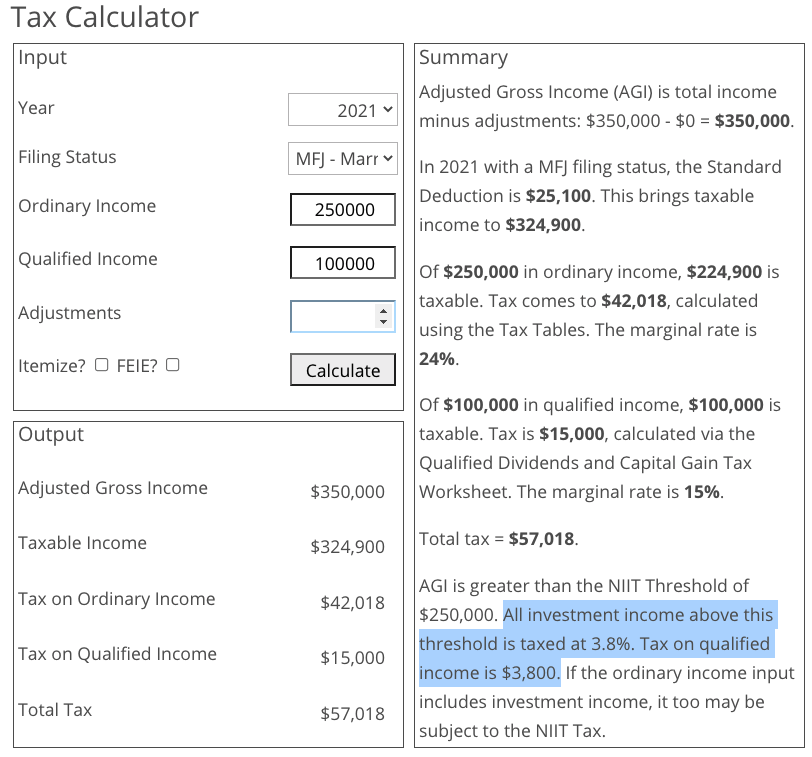

The IRS gives you a pass. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. You are charged 38 of the lesser of net investment.

Internal Revenue Service Code Section 1411 imposes a 38 tax on a taxpayers net investment income. On January 4th the United States Senate voted 51-48 on a motion to move forward with a budget. In the case of an estate or trust the NIIT is 38 percent on the lesser of.

According to previously mentioned JCT. Overview Data and Policy Options Since 2013 certain higher-income individuals have been. There is a flat surtax of 38 on net investment income for married couples who earn more than 250000 of adjusted gross.

A the undistributed net investment income or. The Net Investment Income Tax in Practice. The tax is calculated as 38 of the lesser of 1 net investment income and 2 the amount at which your MAGI exceeds the applicable threshold.

1 day agoStamp Duty Land Tax cuts - On 23 September 2022 the government increased the nil-rate threshold of Stamp Duty Land Tax SDLT from 125000 to 250000 for all. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified. Obamacare And Net Investment Income Tax Repeal.

The net investment income tax will apply to a taxpayer only if their.

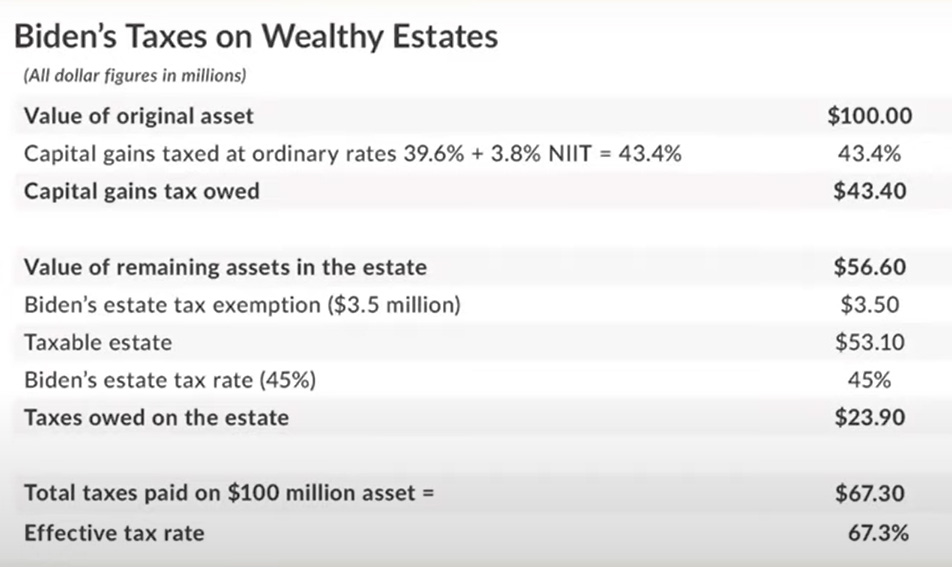

How To Protect Against Biden Tax Plans 2021 Urgent Actions

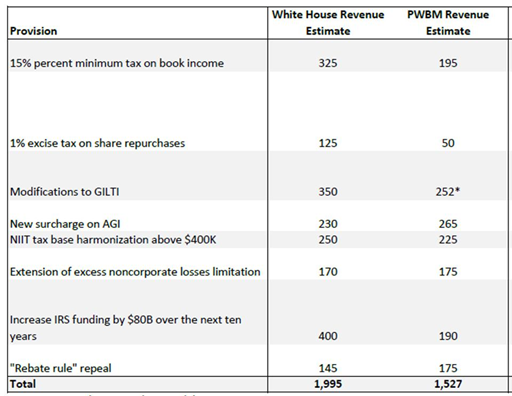

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation

How Biden S Build Back Better Hits Blue States Harder

Forbes Highlights Hit To Pass Throughs The S Corporation Association

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

New Tax Legislation And Its Impact On You And Your Business

House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp

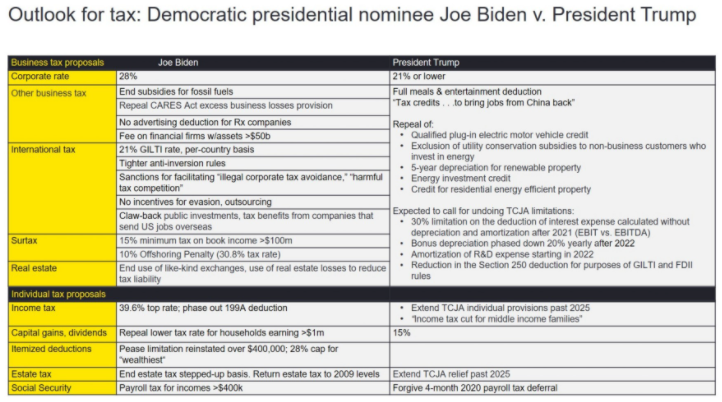

Post 2020 Tax Policy Possibilities Lexology

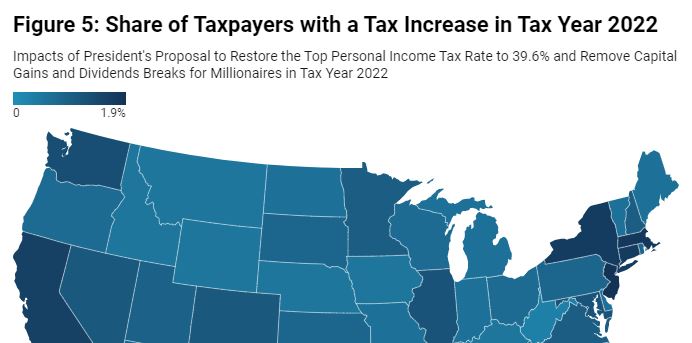

Income Tax Increases In The President S American Families Plan Itep

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

What Is The The Net Investment Income Tax Niit Forbes Advisor

Net Investment Income Tax And How To Avoid It Go Curry Cracker

Time To Plan For Progressive Tax Changes Evercore

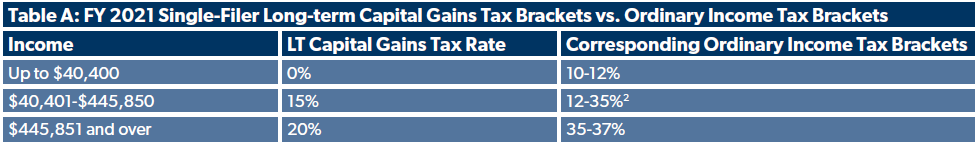

What S The Deal With Capital Gains Taxes Foundation National Taxpayers Union

Top Earning New Yorkers Could Face 61 2 Combined Tax Rate Under House Plan

Low Tax Rates Provide Opportunity To Cash Out With Dividends

Plan Ahead For The 3 8 Net Investment Income Tax Holcombe Holtzclaw Ravan Llc